Table of Content

They have similar loans for home extension or home improvement at more or less the same interest rates and norms. The interest rate on this home loan is lower for women and for farmers as well on the basis of agricultural land owned and the kind of crops. Interest rates are competitive and loans are available for the purchase of plots as well. According to Vivek Iyer, Partner and Leader, Financial Services Risk, Grant Thornton Bharat, loan EMIs will rise further in the near future. Interest rates may be close to peaking as experts see the RBI putting a stop to repo rate hikes in the coming months.

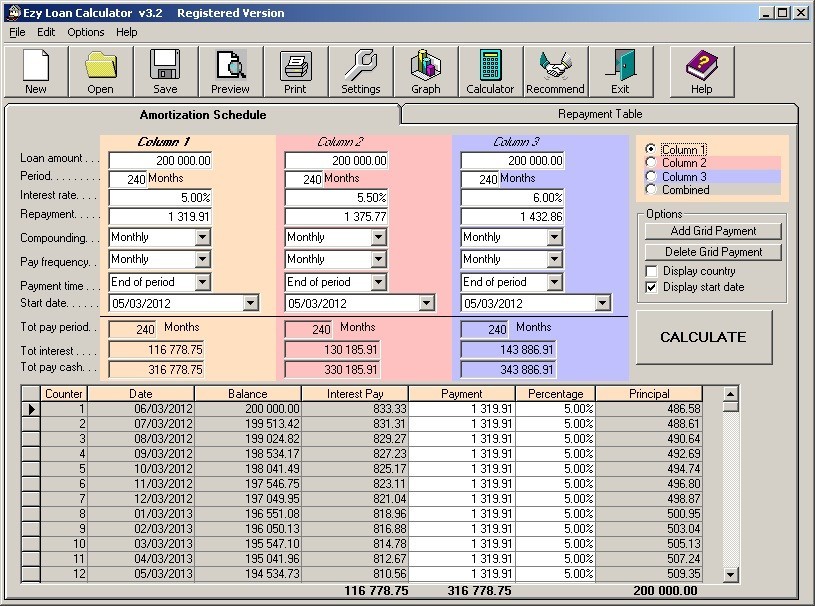

Also, the more money you pay as down payment, the lower your EMIs will be, which means that you will be able to repay your loan earlier. When you prepay a part of your home loan, you have two options. You can either have your lender shorten the tenor, in which case you roughly pay the same amount as EMI, or you can continue with the same tenor, in which case your EMIs reduce.

IRDAI Corporate Agency Registration Number

Your home loan EMI is the monthly payment that you make to repay the home loan as per the amortisation schedule. There are multiple factors driven by your background and income group which influence the rate bank offers you. Let’s look at some of leading factors to help you negotiate the best rate. All you need to do is simply enter your loan details and then enter the amount you wish to pre-pay. Do keep in mind that this amount will have to be at least three times the calculated EMI.

2)Above INR 25 lakh it is 0.25% to the maximum of INR 12,500 +GST. 3)People having a salary account in this bank will get an extra rebate of 0.5%. Forbes Advisor India analyzed 84 home loans to select the ones that are most affordable and comparatively easier to honor.

What are the factors that affect home loan interest rates?

Any increase in the repo rate will increase the interest charged by the bank on any kind of loan and decrease will make the loans cheaper for the customers. Monga of BASIC Home Loan recommends revising the repayment plan to manage the increased EMI burden. This can be done by opting for a longer tenure loan to reduce the EMI burden, he says. "In such scenarios, the borrower would pay a higher total interest amount, but his EMIs would remain the same. It would help the borrower with their cash flow monthly," Monga tells TOI. Also, banks will ultimately decide the additional interest they would charge, on top of the repo rate on home loans. Even though the repo rate is currently at 4%, the cheapest available housing loan in the market current is at 7%, reflecting a difference of three percentage points.

All views and/or recommendations are those of the concerned author personally and made purely for information purposes. Nothing contained in the articles should be construed as business, legal, tax, accounting, investment or other advice or as an advertisement or promotion of any project or developer or locality. Pay your bills, shop online and make payment to any merchant unified payments interface ID easily and instantly. Read the Fine Print – It is very important that you read the fine print before you take a home loan. It may look long and you may be lazy, but reading it will save you from future shocks. The fine print document will contain all the information and term and conditions related to the loan you plan to apply for.

What is a floating rate Home Loan?

He has more than a decade’s experience working with media and publishing companies to help them build expert-led content and establish editorial teams. At Forbes Advisor, he is determined to help readers declutter complex financial jargons and do his bit for India's financial literacy. Information provided on Forbes Advisor is for educational purposes only. Your financial situation is unique and the products and services we review may not be right for your circumstances.

Groww has a wide array of financial tools which you will find listed at the end of this page. When broadening the picture to include these additional expenses, it becomes more transparent to the borrower that the “true” cost of the loan is much higher than just the interest alone. So, the advertised APR will be higher than the interest rate. By clicking on the hyper-link, you will be leaving and entering website operated by other parties. Kotak Mahindra Bank does not control or endorse such websites, and bears no responsibility for them. You can pay off any existing balance of Home Loan using Kotak’s Home Loan Balance Transfer at a lower rate of interest.

"Similarly, if you prepay one additional EMI every year, the loan can be closed in 17 years. If you increase the EMI by 5% every year, the loan can be finished in less than 13 years," Shetty says. Banking regulator RBI is responsible for monitoring and setting the repo rate periodically. The rates are revised bi-monthly during the RBI monetary policy review meetings.

Some EMI calculators for home loan also provide a detailed breakup of the interest and principal amount you will be paying over the entire loan tenure. HDFC also offers a facility of a pre-approved home loan even before you have identified your dream home. A pre-approved home loan is an in-principal approval for a loan given on the basis of your income, creditworthiness and financial position. Simply input the values of the loan amount, the interest rate and the loan tenure and the calculated value will be displayed instantly.

Fixed type of home loan rates are set and there is no fluctuation in the interest amount. However, in certain cases, after using a fixed housing loan interest rate for a certain repayment period, it may convert into a floating housing loan interest rate depending on your loan terms. A lot of salaried Indian consumers find themselves in this situation.

Proof of Identity, address, income, age, property, etc are required to apply for a home loan. Banks consider the market conditions as well as the internal policies before determining your home loan interest rate. Apply at young age – If you age at the time of applying is in early 30s or late 20s.

So, the rate of interest of the housing loan changes in accordance with the repo rate. This also means, your home loan EMI will increase as and when the banking regulator makes any change in its key lending rate. “Consequently, repo rate-linked loans can work against buyers, during the rising interest rate regime, Kukreja warns. Reverse repo rate is the interest which banks charge from the RBI, to lend credit to the banking regulator. Reverse repo rate is another tool used by the RBI, to maintain desired inflation levels, by way of absorbing liquidity from the system. By increasing interest, the RBI encourages banks to lend money to the RBI, which results in depletion of excess liquidity from the system.

No comments:

Post a Comment